Identify and correct I-9 errors before they become fines

I-9 Audit Guide + Process Checklists

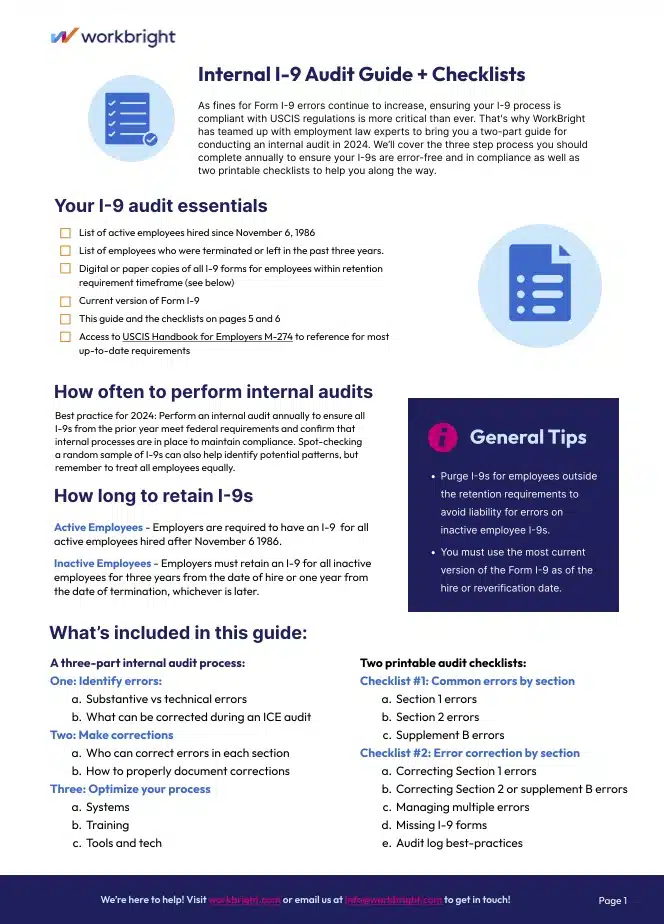

As penalties for Form I-9 errors continue to rise, it’s more critical than ever to ensure your I-9 process is compliant with USCIS regulations. That’s why we’ve collaborated with employment law experts to bring you an essential two-part guide for conducting an internal audit in 2024.

Minimize risk and ensure compliance in 2024

Download our free guide and checklists to:

- Learn the three-step process for ensuring error-free and compliant I-9s.

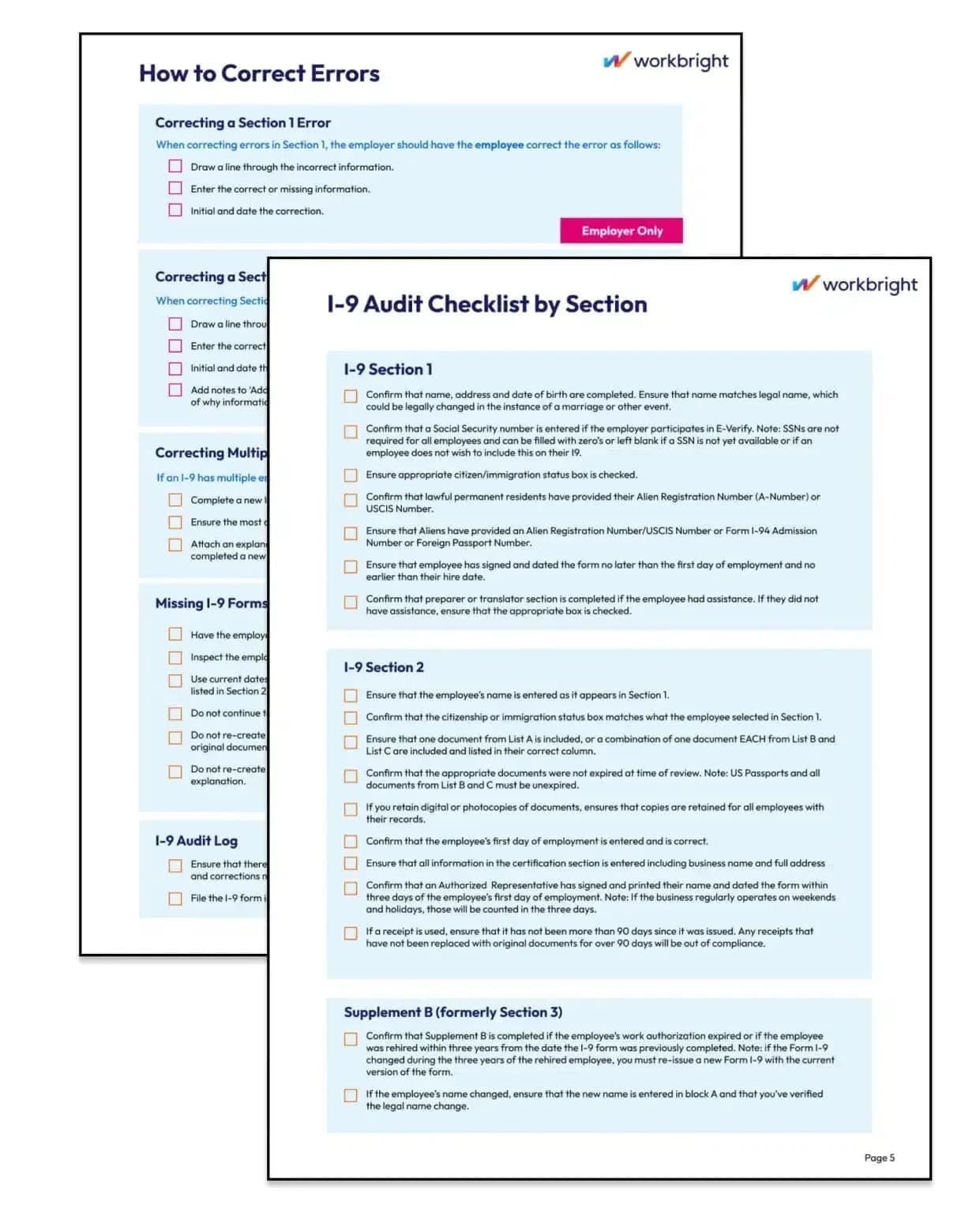

- Identify common errors and how to correct them.

- Optimize your I-9 process to mitigate future risks.

- Access printable checklists to streamline your audit process.

What’s inside the guide?

Here's a sneak peek at what is in our comprehensive I-9 audit guide and checklists.

- A three-part internal audit process to identify and correct errors.

- Two printable checklists for error identification by section.

- Explanations of substantive vs. technical errors.

- Guidance on error correction and documentation.

- Tips for enhancing your I-9 systems and training.

- Best practices for retention, purging, and managing missing forms.

Streamline Your I-9 Process with WorkBright’s Smart I-9

Need to streamline I-9 compliance? WorkBright’s Smart I-9 offers simplicity, security, and speed. Our platform helps you:

- Mitigate errors and audit risk

- Ensure consistent, compliant I-9 processes

- Securely store I-9 files

- Automate E-Verify

- Reduce time-to-hire