The Federal I-9 form is arguably the most important piece of paperwork your new hires will need to complete. Not only is it federal law, but it can come with costly penalties. When you hear I-9 infractions, you probably think of the monetary consequences. However, there are other things to consider like loss of productivity and even employee termination.

What is the monetary cost of I-9 penalties?

I-9 Civil Penalties and Potential Legal Fees

I-9 fines depend on several factors and can range from hundreds to even thousands of dollars per incident. Currently the fine ranges from $252-$2,507 per I-9 form for technical errors as announced by the Department of Homeland Security (DHS). The civil penalty fine amounts can add up exponentially depending on if your organization is in violation of substantive errors, knowingly hired ineligible workers or if there are any uncorrected technical procedural failures. The U.S. government also takes into consideration if this is a first, second, or third infraction when determining the fine amounts.

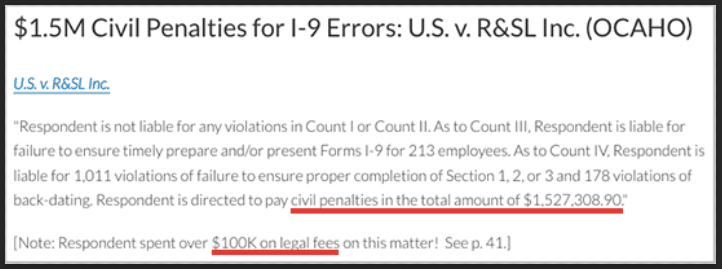

It’s not hard to find numerous cited cases in the news with astronomical fines and legal fees as a result of I-9 violations like the one highlighted below. Since this company was hiring seasonal employees, they had over 1.5 million dollars in penalties with only 50 permanent full time employees.

| Factor | Aggravating | Mitigating | Neutral |

| Business size | + 5% | – 5% | +/- 0% |

| Good faith | + 5% | – 5% | +/- 0% |

| Seriousness | + 5% | – 5% | +/- 0% |

| Unauthorized Worker(s) | + 5% | – 5% | +/- 0% |

| History | + 5% | – 5% | +/- 0% |

| Cumulative Adjustment | + 25% | – 25% | +/- 0% |

Ref: ICE Inspection Fact Sheet

What are the other costs of I-9 infractions?

I-9 infractions can cost more than just monetary fines. This flowchart is from the U.S. Immigrations and Customs Enforcement. It outlines the entire process from the initial audit to the hearing process and everything in between. As you can see, this can be a very extensive process, which will require a lot of resources from your organization.

Loss of productivity

If your company undergoes an I-9 audit and is found to be non-compliant, there are several steps in the process. You may be given 10 days to fix any technical or procedural failures. If you have several failures, think of how much time and energy your employees will spend making those changes. This will divert their attention away from other important HR tasks, like onboarding and hiring new employees.

Termination of employees

If your company unknowingly or even knowingly is employing workers that are not authorized to work in the United States, you may have to terminate them if they cannot provide the necessary documentation proving they are eligible to work. Think about the loss your company will suffer. Not only will you lose an employee, but you’ll also be losing valuable industry knowledge. Not to mention, this will put a strain on the other employees. Your HR department will also likely have to scramble to fill the vacant position.

How can you prevent I-9 Penalties?

Streamline your Onboarding Process

This is one of the best ways you can be proactive against I-9 audit penalties. When your procedures are clear, simple, and easily understood, everyone benefits. Your company’s processes should be clear not only for employees working to onboard new hires but also for the new hires themselves. It can be helpful to new provide hires with a document that lets them know exactly what they need to have ready before completing their paperwork, or use an easy onboarding software to simplify the entire process. Sometimes new hires can be confused by what forms of documentation to provide to complete their I-9 forms, so be sure to review the information with them. Remember, your company cannot tell them which type of documentation they need to provide. The new hire must make that decision based on the documents listed on the I-9 form.

Ensure your employees are adequately trained

Any employee that is involved in the new hire onboarding process should have ample training regarding the I-9 compliance penalties and your company’s processes. When all employees are on the same page, it can help with streamlining your processes and avoiding errors. It’s important to note that training your employees once simply won’t be enough. There are often changes in regulations they will need to be aware of to keep compliant. Consider re-training your employees at least once a year, and each time new regulations are issued. Having a place for employees to reference their training, providing an I-9 audit checklist, and updating it each time there are any changes, can help everyone to remain in compliance with I-9 regulations.

Use I-9 Software to help you

There are a handful of I-9 software choices available to help simplify and maintain compliance based on your company’s individual needs. It’s important to make your selection based on how much time and productivity it will improve, but also how easy it is for you and your employees to use. When you’re evaluating your options, ask yourself the following questions.

- How much will this increase my company’s productivity?

- How much time will this save for my onboarding process?

- Will it mitigate errors with built-in guardrails to ensure my compliance?

- Will it guide my HR team through the documentation process preventing mistakes, such as completing Section 2 after 3 days of work?

- Is this easy to use for both employees and new hires?

- Can all new hires easily complete from their mobile device?

- Will it work well for off-site or remote new hires?

- Do they offer internal audit services and support to ensure compliance?

What are the next steps?

Audit your current processes

This is a great opportunity to be proactive in identifying areas of improvement for your organization. You want to determine if there are any risks involved with your current I-9 procedures and create solutions that mitigate these risks. You can start by asking yourself the following questions.

- Is my I-9 process the same for each new hire?

- Does my company provide adequate training on the I-9 process?

- Are my employees aware of the monetary and non-monetary costs associated with I-9 infractions?

- How does my company handle remote hire I-9 forms?

- How many I-9 mistakes does my company currently have? How will we resolve these issues?

Schedule a free I-9 Audit Exposure consultation

Auditing your organization can be an undertaking in and of itself, not to mention when it involves the stress of potential costly consequences. Ensuring your I-9 compliance processes are adequate is overwhelming, but extremely important.

We’ll help you assess your current Form I-9 workflow to identify vulnerabilities then give you a “Personalized Fine Exposure Estimate and Risk Mitigation Guide” to help you improve your I-9 process. Book your Free 15 minute I-9 Risk Assessment now!